Maywood IL 2-Unit Renovation - Financing

Current Target Net Annual Yield

11.50%

Term

12 Months

Total Investment

$255,000.00

Details

Returns & fees

Annual management fee: 1.50%

Target net annual yield: 11.50%

Schedule

Distribution Frequency: Monthly

Term: 12 Months

Extension options: 3 Months

Structure

Finance Type: Debt – 1st Position

Tax Document: Form 1099-INT

Overview

A senior secured loan collateralized by a newly rehabbed single family residence in Maywood. The loan is a bridge loan and will provide the borrower with time to sell the property in the upcoming spring.

- Location: The asset is a promising project, partly due to its strategic location. Situated within walking distance of Hines Jr. Veterans Administration Hospital, the property attracts a high demand for rental housing, particularly from traveling nurses. Several investors have shown keen interest in this property post-renovation.

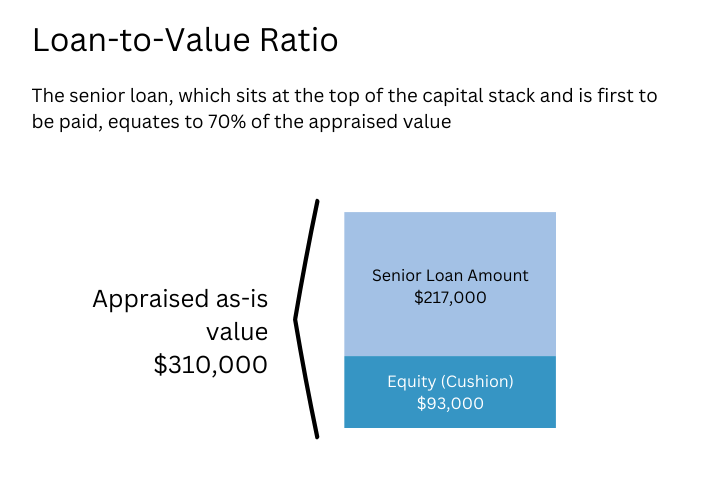

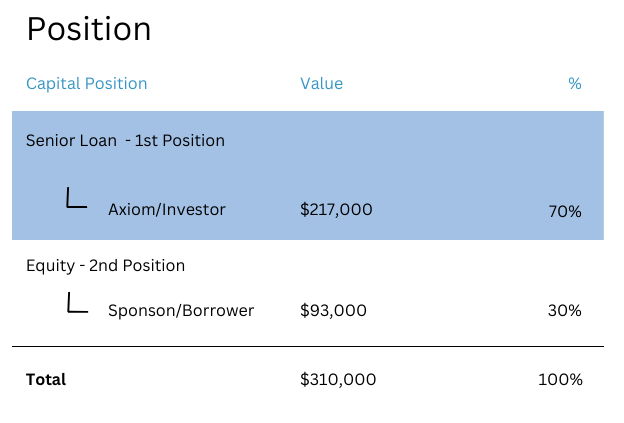

- Senior Loan: This loan is in the senior position, meaning that there is significant equity, based on the appraised value.

- Community Support: This property was sold by the Cook County Land Bank Authority. In lieu, there is significant community and municipal incentive to see the success of this project.

Investment Details

- This is a senior positioned loan secured by the subject property. This collateral is a newly rehabbed 4-bedroom, 2-bathroom 2-Unit multifamily residence with 1,633 sq feet. The address is 2128 S 10th Ave, Maywood, IL 60153.

- The loan will fund the cost for acquisition and renovation.

- As proof of the Cook County Land Bank’s Authority’s commitment, they implemented a $20,000 FORGIVABLE loan to incentivize the sponsors to complete the project and sell the home to a homeowner.

- The initial term of the loan is 12 months with a 3-month extension option. The loan is structured with two months of interest reserves in an escrow account to be funded at the anticipated closing. The borrower is expected to pay interest out of pocket to maintain that interest in escrow.

Investment Strategy

- The proceeds of the loan will be used to purchase the property, renovate, fund a 2-month interest reserve, and pay closing costs. The property requires significant renovations – $178,000. However, once completed, it will be turn-key and exceed all FHA standards.

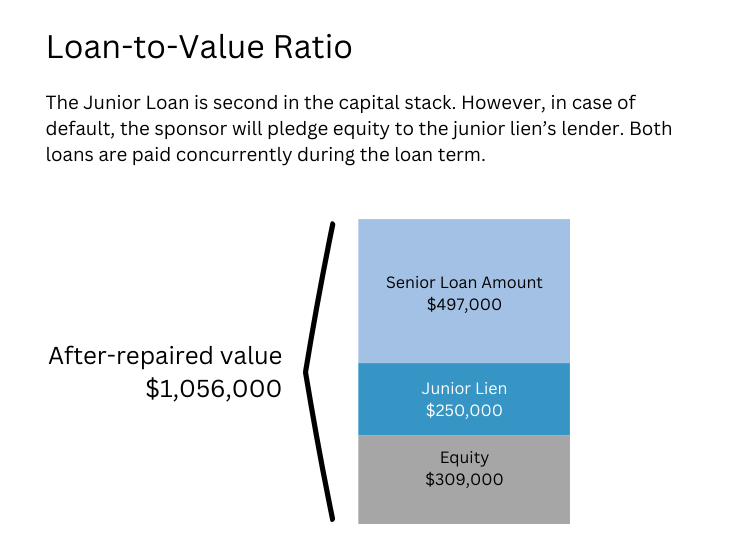

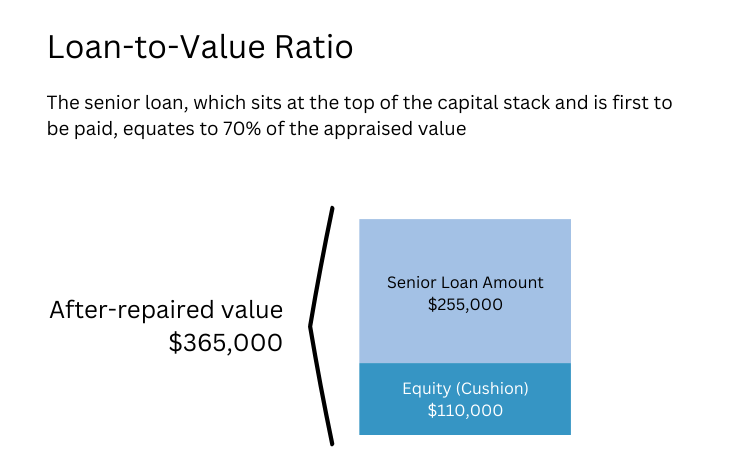

- The property’s ARV (After-Repaired-Value) is valued at $365,000. The loan has a loan-to-value ratio of 70%. There is a 30% cushion, in the form of equity, that provides the security for this loan.

- The borrower is required to pay the interest on this loan on a monthly basis. Additionally, the full loan will be repaid at the end of the term or when the property is sold (whichever is sooner).

- Axiom will be a direct note holder, and the note will be monitored and managed by a preferred Loan Servicer.

Investment Framework

The Sponsor

The Principals of GR Engineering, LLC are both General Contractors and Engineers by profession. The owners, Gremell Pickens – Electrical Engineer and Robert Elliott – Mechanical Engineer, possess a combined 50+ years of corporate experience in engineering, construction, and facility maintenance. Outside of their engineering profession, they have over 35 full Commercial and Residential Property renovations totaling over $9.5 Million to date. Additionally, they were just awarded the Southwest Suburbs Developer of the year by the Cook County Land Bank.

They maintain several certifications:

- Small Business

- Minority Owned Business

- Small Disadvantage Business Certified

- HUB Zone Self Certified

- City of Chicago DBE Certified

- State of Illinois MBE: Certified

The Originator

- At Axiom Capital Resource, we are a privately held real estate investment firm. We have over 20 years of experience in loan origination, renovation management, acquisition, financing, mortgage note guidance, and risk mitigation.

- Our firm focuses on lending to developers and using that knowledge to identify sound underwriting guidelines.

- We have funded over $265M worth of loans; and in doing so, we truly understand risk.

Market Factors

Reasons to consider this investment

- Proximity to Downtown Chicago: Maywood is an incorporated village sitting within Cook County, Illinois and just 11 miles west of downtown Chicago, and is an easy commute on either the Metra West line or Interstate 290.

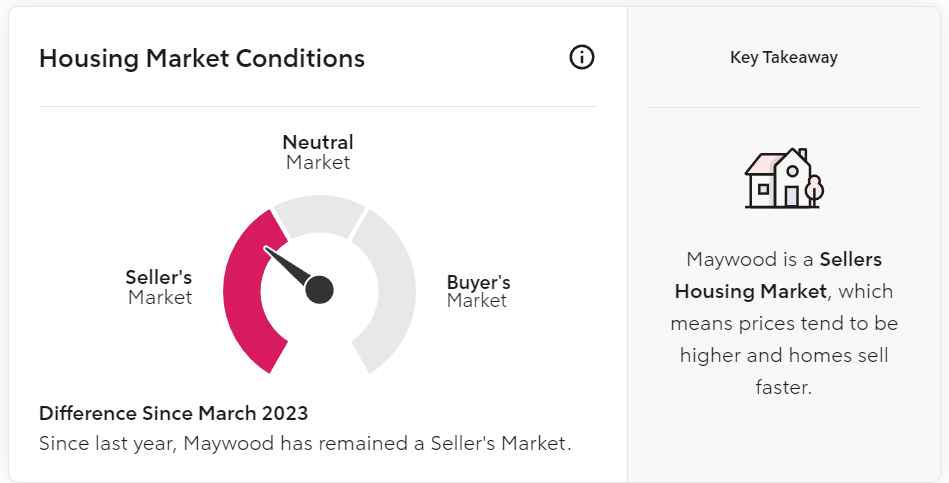

- The suburban Chicago village is still a seller’s market. In fact, in February 2024, Maywood home prices were up 8.9% compared to last year.

Source: Rocket Mortgage

The Financials

Capital Structure

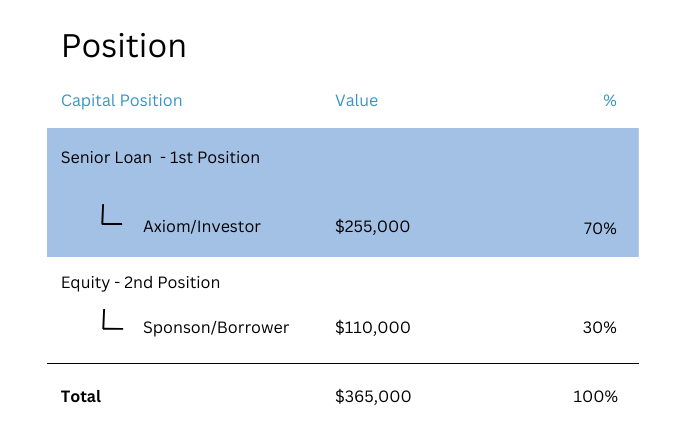

- As the originator we are providing the borrower $255,000 in a senior loan position. The capital will be secured by the real estate asset.

- Axiom will be the direct note holder. All investor capital is managed by a 3rd-party loan servicer.

Payment Distribution

- The loan is a fixed rate and expected to pay interest on a monthly basis.

- As the loan is paid by the borrower, 1% of the loan amount will be paid to Axiom for management fees and other expenses; the remaining 11.05% is paid to the investor – a 3rd party Loan Servicer will manage payment distributions.

Post investment

What to expect after you invest?

- Monthly payments prepared by a 3rd-party Loan Servicer for the duration of the loan term.

- Investors should expect to receive a 1099-INT tax document for this investment. 1099’s will be made available between January and March of the following year.

Our best opportunities often come from sponsors (borrowers) who are creditworthy, have solid collateral, and a strong track record. However, many of their projects may not fit into the specific and stringent requirements of a bank loan. Real estate developers understand the best deals are those that are distressed. A sponsor acquires a struggling asset at a steep discount. So-called distressed properties fail to perform at their full potential for a variety of reasons. Banks prefer lending on currently performing assets. These situations provide great opportunities for Axiom’s investors.

Comments/Questions

If you have any questions about this offer, we would be happy to assist you.

Looking for a different type of investment?

Axiom Capital Resource offers strategically designed and expertly managed solutions for you to invest in a variety of real estate opportunities. To give us an idea of your investment criteria.

Frequently Asked Questions

How does Axiom Work?

Axiom is a private real estate investment company founded on the principle of creating partnerships to invest in real estate. With our partners, we invest in real estate and mortgage notes.

What is a Promissory Note?

A mortgage note is a legal document signed when closing on a mortgage. The mortgage note contains details about a loan, including interest, monthly payments, and penalties for late payments. The mortgage note establishes the property as collateral for the loan.

Who manages the Note Payments?

Many investors choose to manage their payments. However, if you need assistance, we suggest utilizing a Mortgage Note Servicer. A Servicer is an independent third-party to which borrowers pay their mortgage loan payments and which performs other services in connection with mortgages including handles all aspects of servicing, default, foreclosures.

Can I use my Self-Directed IRA?

Yes. This investment provides investors with a way to utilize their self-directed traditional IRA or Roth IRA. We can recommend several custodian companies that handle the paperwork and hold your IRA while the funds are invested with us.

Benefits of Investing

Real Estate as Collateral

Nothing gives a private lender more peace than knowing that there will be something to fall back on should things turn out negatively. However, our focus is to maintain a good reputation with our investors; therefore, repayment is our priority. However, if the worst happens, there will be a valuable asset to protect your capital investment. The property can be seized via a foreclosure, ensuring that there will not be any loss to be suffered.

Short Terms/Duration Exposure

Private lending to sponsors (real estate investors) provides an opportunity for you to get higher returns within a shorter time compared to other forms of investment. Beyond these high returns on the investment made, the time taken to repay private money loans is usually short. Short terms of loans imply that the investment will be paid back with accrued interest in a much shorter timeframe than with conventional investments.

Control of ROI

In some other types of investments such as the stock market, your returns are based on how such markets will perform. Therefore, you have no assurance on whether you will get returns on your investment or not. In this case, you will know how much you will get from a real estate investor on a monthly basis. Rather than looking at the investment to profit in the future, you are sure to get a specific return since you came up with the loan terms.