What is Debt Investing

Debt Investment (sometimes called “Private Credit”, “Private Lending” or “Note Investing) is an asset class that generally consists of loans, fixed-income, or other structured investments that aim to deliver higher yields with lower overall risk when compared to equity investments. In other words, investors in debt investments are lending money to borrowers in exchange for a fixed rate of return (often captured in the form of an interest rate or preferred return) but typically do not have any equity ownership or upside participation.

Note investor invests in debt instruments, specifically promissory notes. A promissory note is a legal document that outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant terms.

Summary of Debt Investing

- Better for those with lower risk tolerances

- More predictable returns

- Typically shorter hold periods

- Regular payments; typically monthly

- Substantial property equity cushions to protect investor capital (loans are made at low loan to value ratios)

Lower Risk

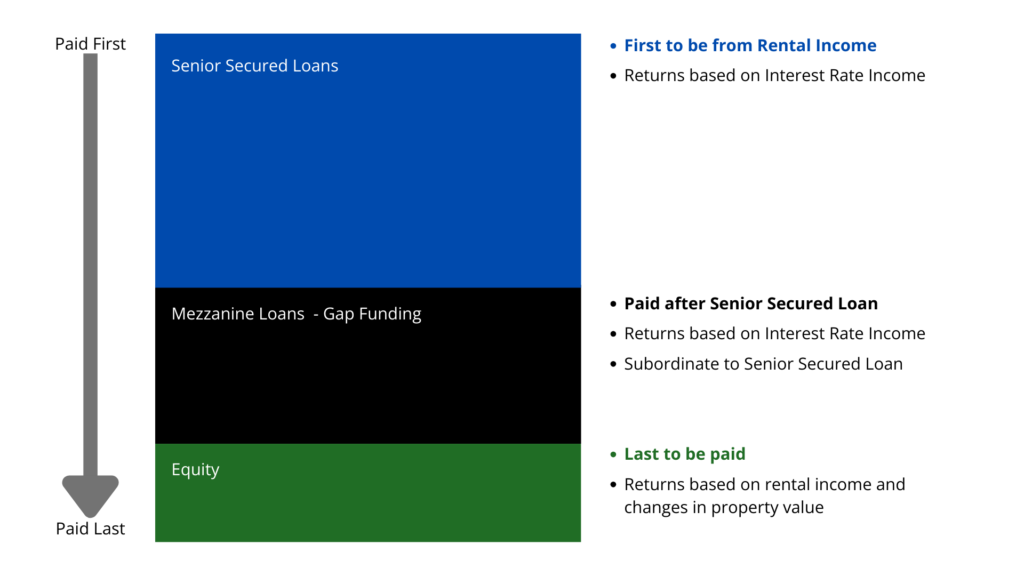

Investors in commercial real estate debt serve as lenders to property owners to help purchase, renovate or repurpose a property. An investor’s return is largely driven by the interest income paid on the loan (or other form of debt) and retains a degree of insulation. That is, commercial real estate debt investors are paid ahead of property owners, which is important if there is a change in the amount of income a property generates or the value of a property.

The Opportunity

The Cause

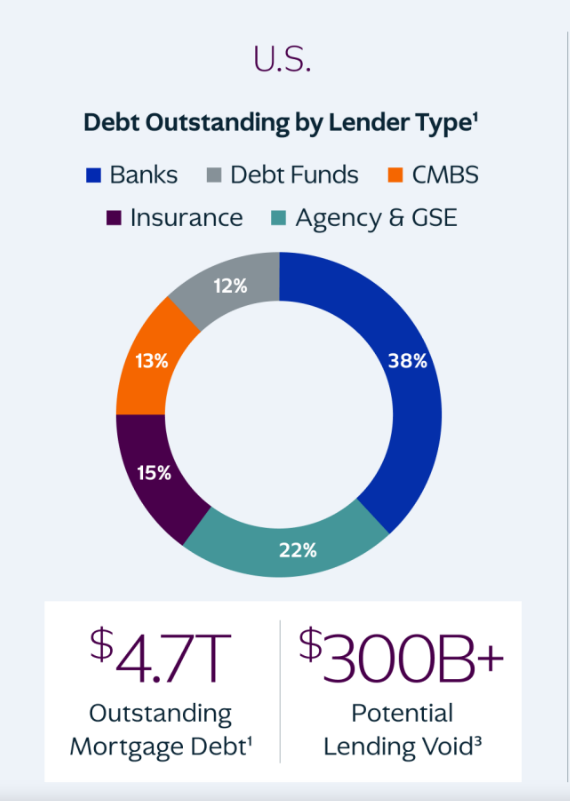

As rates increased, some banks failed or were on the brink. In lieu, we also saw a significant pullback of bank lending. Banks hold approximately 50% of outstanding commercial real estate debt (See below), and face increased regulatory scrutiny and challenges within their existing portfolios, many of which contain significant office exposure. A number of private debt funds and mortgage REITs are also on the sidelines due to credit problems and the inability to source efficient senior financing. Capital markets activity also declined in 2023, with private label CMBS issuance declining 53% year over year.

The Effect

As of this year, transaction volume has increased. In 2023, U.S. government agencies, insurance companies and some private debt funds provided most of the financing the market needed. However, banks are not expected to revert to their previous lending activity. Moreover, after last year’s regional bank failures and decline in property values, banks’ liquidity and commercial real estate portfolios, specifically their office exposure, are under heavy scrutiny.

Because of this anticipated gap in credit, we expect alternate providers of capital to have a significant opportunity to lend on high-quality, well-located real estate at attractive yields and terms.

Interested in Learning More?

Axiom Capital Resource offers strategically designed and expertly managed solutions for you to invest in a variety of real estate opportunities.