Debt vs Equity Investing

There are two main ways to invest in real estate: Debt and Equity. Debt investments involve lending money to borrowers who purchase a property with the expectation of earning interest on that loan.

Equity investment is a form of investing where the investor acts as a shareholder in the property that they’re investing in. The most notable aspect of investing in equity is that returns are obtained in the form of a certain share of the profit that the property is able to generate.

Highlights of Equity Investing

- Higher Return Potential: Investors benefit directly from increases in property value and rental income.

- Tax Advantages: There are various tax deductions and credits available to equity investors in real estate, such as depreciation and mortgage interest deductions.

- Appreciation: As appreciate increases, so does equity and profit potential.

- Control: Owners have a greater degree of control over what happens with the asset.

- Inflation Hedge: Real estate often serves as an effective hedge against inflation, with property values and rents typically increasing with inflation.

Higher Rewards and Associated Risks

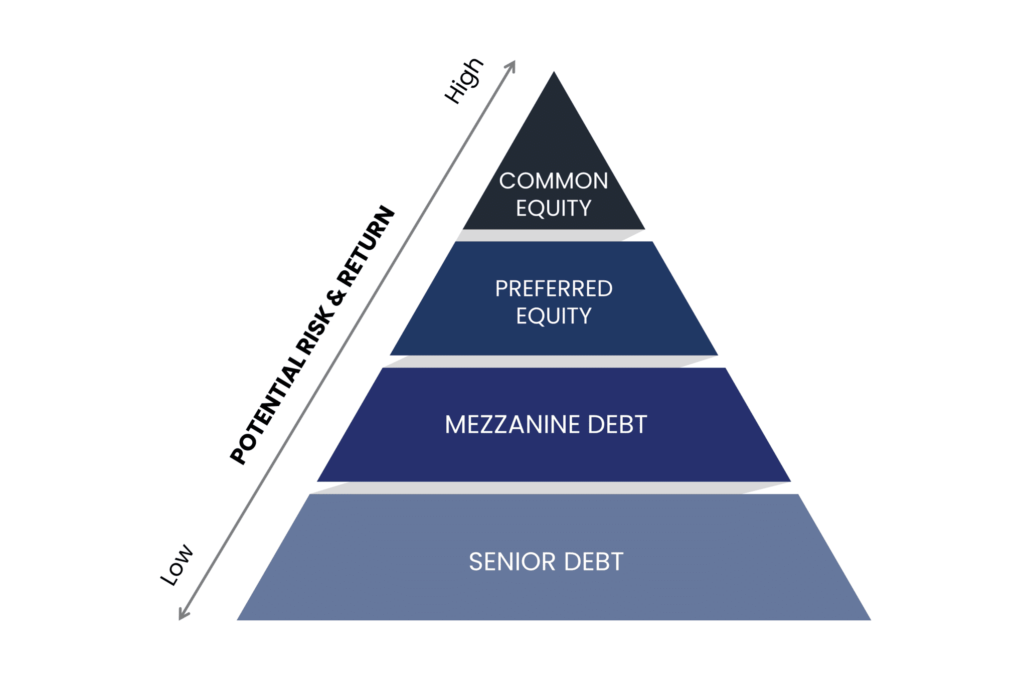

Both Debt (via Private Credit) and Equity have risk/reward ratios. Typically, debt has lower risk and a lower reward – debt investments pay a fixed rate of return.

Equity investments offer the potential for higher returns, especially in markets where property values are rising. Investors benefit directly from increases in property value and rental income.

Tiered Risk Approach: Investors might choose to invest in debt for more conservative, stable returns, allocating a portion of their portfolio to equity investments for higher growth potential. This tiered approach allows for a customized risk-return profile based on individual preferences.

In a Capital Stack, Equity investors are paid AFTER Debt investments are paid.

No cap on returns: Equity investments offer greater earning potential. It’s possible to have annualized returns ranging from 18% to 25%. Since there’s no cap, however, there is no set limit from an investor’s perspective.

Real Estate: Non-Correlated to Stocks

Real estate and stocks are the most widely held assets among investors. While both provide the potential for substantial profits, they differ in rates of return, risk, liquidity and accessibility.

Real estate is an essential type of uncorrelated asset. Individual properties and non-traded real estate investment trusts (REITs) usually perform independently from stock market assets. While real estate still fluctuates in value, these assets tend to fluctuate when other parts of your portfolio are doing something else. Their non-correlation provides fewer fluctuations in your portfolio’s value, smoothing out the overall returns.

Real Estate vs Stocks

Historically, real estate has featured a combination of traits not found in other asset classes: long-term earning potential and effective diversification beyond the stock market.

Tangible Asset

For many prospective investors, real estate is appealing because it is a tangible asset that can be controlled, with the added benefit of diversification.

Wealth preservation and growth

Alternative assets like real estate have historically offered a unique combination of lower volatility than stocks and higher potential returns than bonds. This mixture can anchor your portfolio, smoothing out the wild ups and downs of the public markets.

Sensitivity to Market Conditions

Stocks are more subject to market, economic, and inflationary risks. Real estate tends to increase and/or decrease slowly allowing an investor to pivot if necessary.

Regardless of which type of investment you choose, it’s important to diversify your investment portfolio. This means investing in different types of assets in order to mitigate risk.

Interested in Learning More?

Axiom Capital Resource offers strategically designed and expertly managed solutions for you to invest in a variety of real estate opportunities.